Islamic vs Conventional Banking for Car Financing: A Effective Guide to Choosing the Right System 2026

Introduction

The debate over Islamic vs Conventional Banking for Car Financing has come decreasingly important as further consumers seek fiscal results aligned with their values, beliefs, and long- term affordability pretensions. Auto backing is n’t just about getting a vehicle; it’s a fiscal commitment that can affect your yearly budget, savings, and fiscal stability for times.

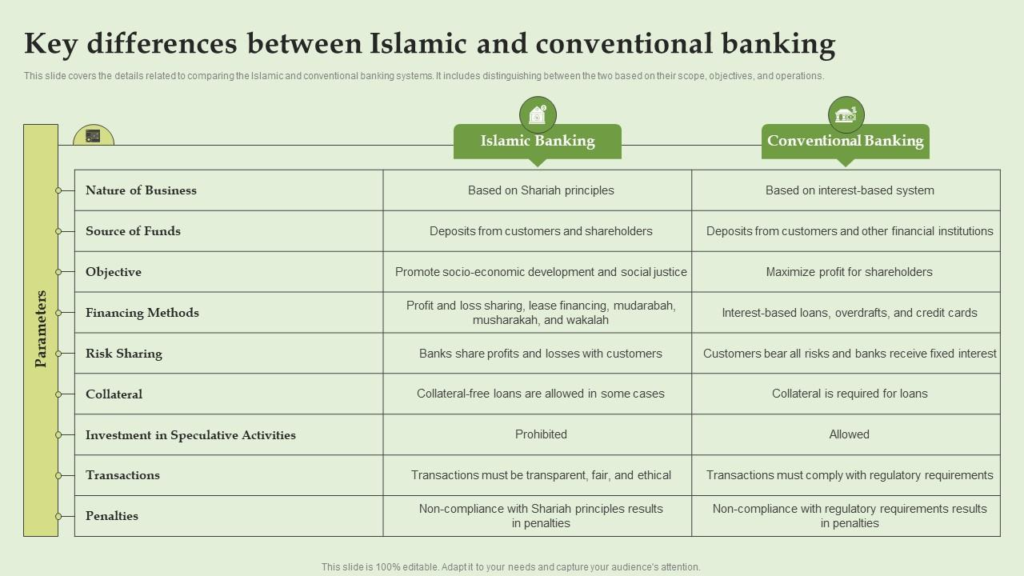

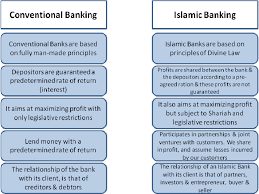

Islamic banking operates on Shariah- biddable principles that enjoin interest and promote ethical investments, while conventional banking relies on interest- grounded lending systems. Understanding the differences between these two approaches allows buyers to make informed opinions that suit both their fiscal situation and particular beliefs. The choice between Islamic vs Conventional Banking for Car Financing is thus not simply specialized but also practical and philosophical, especially in countries where both systems are extensively available.

The part of Interest and Profit Models in Islamic vs Conventional Banking for Car Financing and How They Shape Financial scores

In the comparison of Islamic vs Conventional Banking for Car Financing, the most defining distinction lies in how each system generates earnings from the sale. Conventional banks calculate on interest as their primary source of profit, which means borrowers must repay the loan quantum along with an fresh chance calculated over time.

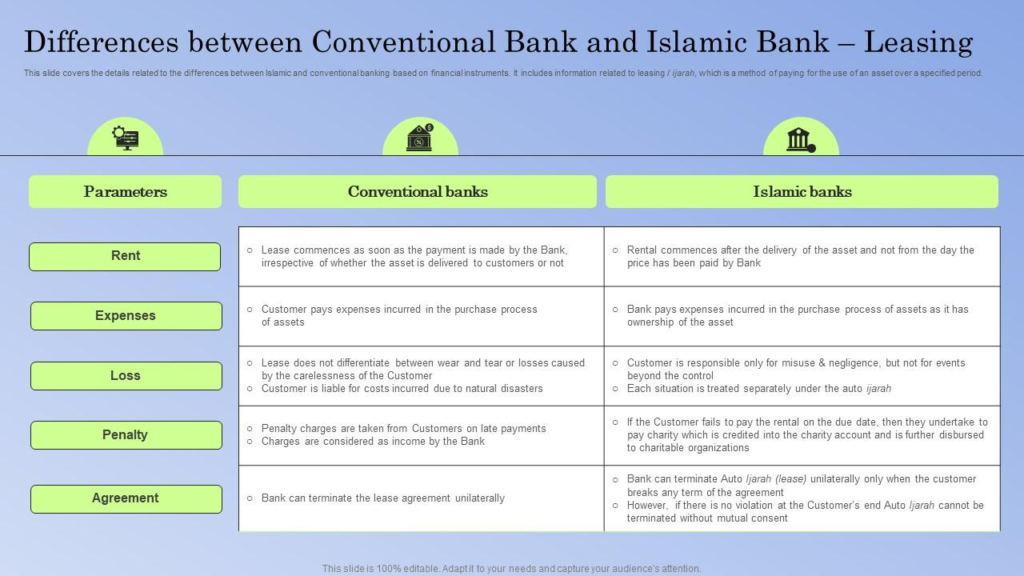

This chance may be fixed or variable depending on the agreement. Islamic backing, still, replaces interest with trade- grounded or parcel- grounded contracts in which profit is agreed upon outspoken. The bank may buy the auto and resell it at a luxury or lease it until payments are completed. This difference changes not only the language but also the fiscal psychology of the borrower, as payments are tied to a palpable asset rather than a debt instrument. Understanding this structural discrepancy helps buyers estimate scores easily before subscribing any agreement.

Translucency and Contract Clarity in Islamic vs Conventional Banking for Auto Backing Agreements

translucency is a pivotal factor when assaying Islamic vs Conventional Banking for Car Financing because contract clarity directly affects client confidence. Conventional loan agreements frequently include specialized fiscal language, shifting clauses, and tentative charges that may be delicate for first- time buyers to interpret without expert guidance. Islamic backing contracts, by discrepancy, are generally structured to outline every cost, power stage, and payment detail in advance, since translucency is a core principle of Shariah- biddable finance.

This can make it easier for guests to understand exactly what they’re agreeing to and how important they will pay in total. still, clarity eventually depends on the institution rather than the system alone. Buyers comparing Islamic vs Conventional Banking for Car Financing should precisely read all attestation, icing that retired freights, penalties, and liabilities are easily explained before committing.

Inflexibility of Payment Plans in Islamic vs Conventional Banking for Car Financing and Its Effect on Borrowers

Payment inflexibility plays a major part in deciding between Islamic vs Conventional Banking for Car Financing because it determines how fluently borrowers can manage inaugurations during changing fiscal situations. Conventional banks frequently give multiple prepayment options similar as malleable term, refinancing openings, or installment restructuring if fiscal difficulty occurs. Islamic banks also offer inflexibility, but it’s structured else to maintain compliance with ethical guidelines.

For illustration, rather of modifying interest rates, they may acclimate payment schedules or extend parcel durations. The position of inflexibility varies from institution to institution, which means borrowers should compare offers rather than assuming one system is always further adaptable. When assessing Islamic vs Conventional Banking for Car Financing, understanding how each option handles missed payments, early agreements, or fiscal extremities is essential for avoiding stress latterly.

Threat participating Principles in Islamic vs Conventional Banking for Car Financing and Why They Matter

Risk distribution is another important distinction in Islamic vs Conventional Banking for Car Backing that influences how responsibility is participated between lender and client. In conventional backing, utmost of the fiscal threat rests on the borrower because they must repay the loan anyhow of what happens to the asset. Islamic backing models, still, are designed to partake certain pitfalls between both parties since the bank may technically enjoy the vehicle during part of the agreement.

This participated- threat approach can produce a sense of cooperation rather than a purely creditor- debtor relationship. It also encourages fair haggling and discourages exploitative terms. Still, the extent of threat sharing depends on the specific contract type used. assessing Islamic vs Conventional Banking for Car Financing from a threat perspective allows guests to choose an arrangement that feels balanced and secure.

Request Vacuity and Availability of Islamic vs Conventional Banking for Car Financing in Modern husbandry

Availability is a practical factor that explosively influences opinions about Islamic vs Conventional Banking for Car Financing. Conventional backing is generally more wide, with a larger number of banks, dealerships, and fiscal institutions offering loan options. This wide vacuity frequently means faster blessings and more competitive promotional deals.

Islamic backing, while growing fleetly, may be limited to certain banks or regions, which can circumscribe choices for some buyers. still, demand for Shariah- biddable products has increased significantly in recent times, leading to further institutions offering Islamic auto backing results. As a result, the gap in vacuity between Islamic vs Conventional Banking for Car Financing is gradationally narrowing. Buyers should explore original fiscal providers, compare offers, and assess convenience factors similar as branch access, online services, and processing times before deciding.

The Cerebral Comfort Factor in Choosing Between Islamic vs Conventional Banking for Car Financing

Beyond figures and contracts, emotional and cerebral comfort also impact the decision between Islamic vs Conventional Banking for Car Financing. numerous guests feel more secure when their fiscal deals align with their beliefs or particular doctrines. For individualities who prioritize faith- grounded compliance, Islamic backing can give peace of mind because it avoids interest and follows ethical investment principles.

Others may feel more comfortable with conventional systems simply because they’re familiar, extensively used, and straightforward in structure. Confidence in a backing choice frequently leads to better fiscal discipline and timely payments. thus, when considering Islamic vs Conventional Banking for Car Financing, borrowers should n’t ignore how comfortable they feel with the system’s principles, language, and scores, since peace of mind is an important part of any long- term fiscal commitment.

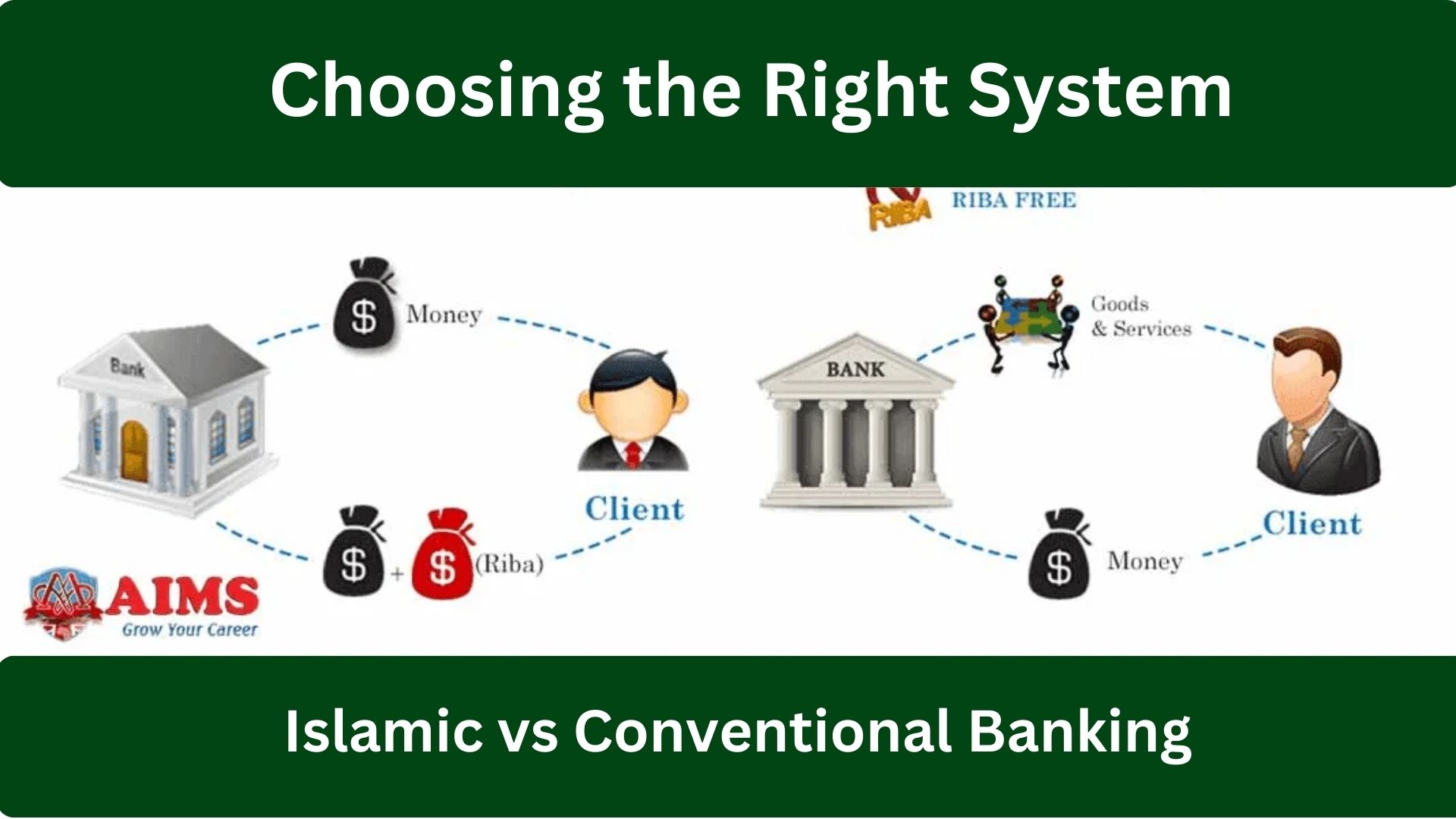

How Islamic vs Conventional Banking for Car Financing Works in Practice and What Makes Their Structures Different

When comparing Islamic vs Conventional Banking for Car Financing, the structural differences are significant. Conventional banks generally give a loan to buy a auto, and the borrower repays the star plus interest over a fixed period. The bank earns profit through the interest rate charged on the loan. In discrepancy, Islamic banks use asset- grounded backing models similar as Murabaha or Ijarah. rather of advancing plutocrat, the bank buys the auto and sells or leases it to the client at an agreed profit periphery.

This means the sale is grounded on trade rather than interest. Because of these distinctions, guests assessing Islamic vs Conventional Banking for Car Financing frequently find that payment structures, power terms, and threat sharing differ mainly. These variations impact not only yearly payments but also the legal and ethical frame of the agreement.

Fiscal Costs and Profit Structures in Islamic vs Conventional Banking for Car Financing Explained in Detail

Cost comparison is one of the most important factors when assaying Islamic vs Conventional Banking for Car Financing. In conventional backing, interest rates may change depending on request conditions, credit scores, and central bank programs. This can make long- term costs uncertain. Islamic backing, on the other hand, generally sets a fixed profit rate at the launch of the contract, which remains unchanged throughout the term.

For numerous buyers, this pungency is a major advantage. still, the original profit periphery in Islamic plans can occasionally appear advanced than conventional interest rates, though the total outstanding quantum may be analogous when all freights are considered. thus, anyone studying Islamic vs Conventional Banking for Car Financing should compare total prepayment numbers rather than fastening only on yearly inaugurations. This comprehensive view ensures a fair and accurate fiscal comparison.

Religious and Ethical Considerations That impact opinions About Islamic vs Conventional Banking for Car Financing

For numerous individualities, the choice between Islamic vs Conventional Banking for Car Financing is shaped by religious values and ethical considerations. Islamic finance follows Shariah principles, which enjoin riba( interest), inordinate query, and investments in banned diligence. This makes Islamic banking appealing to people who want fiscal dealings aligned with faith- grounded guidelines.

Conventional banking, while extensively accessible and frequently simpler in structure, does n’t follow these religious restrictions. Some guests may prioritize convenience or lower original rates, while others prioritize compliance with religious training. assessing Islamic vs Conventional Banking for Car Financing from an ethical perspective helps borrowers feel confident and comfortable with their decision, knowing it reflects their particular principles as well as their fiscal pretensions.

Blessing Criteria and Eligibility Differences Between Islamic vs Conventional Banking for Car Financing Options

Eligibility conditions also vary when comparing Islamic vs Conventional Banking for Car Financing. Conventional banks generally assess aspirants grounded on credit history, income position, employment stability, and debt- to- income rate. Islamic banks consider analogous fiscal factors but may also estimate whether the sale meets Shariah guidelines and whether the asset being financed complies with admissible norms.

Attestation processes may differ slightly, and blessing times can vary depending on the institution. Some guests find conventional backing briskly due to standardized procedures, while others prefer the translucency of Islamic contracts. Understanding these distinctions is essential when deciding between Islamic vs Conventional Banking for Car Financing, as blessing conditions can impact which option is really accessible.

Long- Term Financial Impact of Choosing Islamic vs Conventional Banking for Car Financing on Your Budget and Stability

The long- term fiscal consequences of opting Islamic vs Conventional Banking for Car Financing extend beyond yearly inaugurations. Conventional loans with variable interest rates can come more precious if request rates rise. Islamic backing generally avoids this query by fixing profit perimeters at the onset. also, some Islamic contracts include clearer power transfer terms, which can give consolation about asset rights. still, early agreement programs, penalties, and executive charges may differ between institutions. Anyone assaying Islamic vs Conventional Banking for Car Financing should review contract details precisely to understand total costs over the entire backing period. This long- term perspective ensures that the chosen system supports fiscal stability rather than creating unanticipated burdens.

Advantages and Limitations of Islamic vs Conventional Banking for Car Backing That Every Buyer Should estimate Precisely

Every backing system has strengths and limitations, and Islamic vs Conventional Banking for Car Financing is no exception. Islamic backing offers ethical compliance, fixed profit rates, and asset- backed deals, which numerous guests find reassuring. Conventional backing frequently provides wider vacuity, flexible prepayment plans, and occasionally lower original rates. still, it involves interest and may expose borrowers to rate oscillations. importing these pros and cons is pivotal because the right choice depends on individual precedences similar as religious beliefs, fiscal inflexibility, and threat forbearance. By precisely studying Islamic vs Conventional Banking for Car Financing, buyers can align their backing decision with both their life requirements and long- term fiscal plans.

Conclusion

picking between Islamic vs Conventional Banking for Car Financing requires thoughtful comparison rather than quick hypotheticals. Each system offers distinct advantages, structures, and fiscal counteraccusations . The stylish choice depends on particular precedences, whether they involve ethical compliance, predictable payments, lower outspoken costs, or flexible terms. By assaying contract details, total prepayment quantities, and eligibility conditions, buyers can choose confidently. Eventually, understanding Islamic vs Conventional Banking for Car Financing empowers consumers to secure a vehicle in a way that supports both their fiscal well- being and particular values.

FAQs

What is the main difference between Islamic and conventional car financing?

The main difference lies in the structure: Islamic financing is asset-based and interest-free, while conventional financing is loan-based and uses interest.

Is Islamic car financing more expensive than conventional financing?

Not necessarily. While profit rates may seem higher initially, the total cost can be similar when all fees and rate changes are considered.

Can non-Muslims use Islamic car financing?

Yes, Islamic banking services are available to anyone regardless of religion, as they are financial products rather than religious memberships.

Which option is easier to get approved for?

Approval depends on income, credit profile, and bank policies, so either system can be easier depending on individual circumstances.

Which system is safer financially in the long term?

Safety depends on contract terms, but fixed profit structures in Islamic plans can provide more predictable long-term costs.