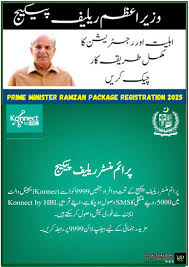

Govt Opens 500,000 Digital Wallets for Women Under Ramadan Package for Effective Financial Inclusion

Introduction

In a corner action aimed at promoting fiscal addition and empowering women across the country under Ramdan package, the government has blazoned the opening of 500,000 digital holdalls

for women under the Ramadan package. This action forms part of a broader strategy to integrate women into the digital frugality and give them with accessible fiscal tools that can help them share in profitable conditioning with ease and security.

The move to give digital holdalls

to women under the Ramadan package reflects the government’s commitment to inclusive growth. Digital wallets are a accessible, secure, and ultramodern fiscal result that allows druggies to conduct deals, pay bills, admit finances, and indeed make online purchases without the need for physical bank accounts. For numerous women in pastoral and civic areas, this step represents a significant stride towards fiscal independence and commission.

Purpose of Opening 500,000 Digital holdalls for Women

The primary ideal behind opening 500,000 digital holdalls for women under the Ramadan package is to enhance fiscal availability for women. Historically, women in numerous regions have faced hurdles in opening bank accounts or sharing completely in the fiscal sector due to social, artistic, and logistical walls. By launching this program under the Ramadan package, the government ensures that women can profit from a cashless, digital-friendly frugality.

The action also aims to support women entrepreneurs, small business possessors, and housekeepers who are decreasingly engaging in online and offline commerce. By furnishing them with digital holdalls, these women can safely admit payments, manage their finances, and contribute economically without demanding expansive fiscal knowledge or access to traditional banking structure.

Impact on Women’s fiscal Addition

fiscal addition is a critical factor in profitable development, and empowering women to share in the fiscal system can have far- reaching goods. By opening 500,000 digital holdalls

for women under the Ramadan package, the government is addressing gender difference in fiscal access.

Women with digital holdalls

can admit direct fiscal backing, government subventions, and other forms of support accessibly. This also ensures translucency in disbursement, reduces reliance on interposers, and minimizes implicit abuse of finances. also, women can now take charge of ménage fiscal planning, savings, and investment opinions, contributing to both particular and community growth.

part in Promoting Digital Economy

The action to open digital holdalls

is aligned with the country’s broader vision of a cashless, digital-first frugality. With 500,000 women now suitable to share in digital deals under the Ramadan package, the government is fostering digital knowledge, technological relinquishment, and online fiscal engagement. Digital holdalls reduce the reliance on cash, minimize sale costs, and enhance convenience. Women entrepreneurs can now admit payments from guests across the country, engage ine-commerce, and expand their businesses. The move also encourages invention, as women explore digital results for business growth, savings, and fiscal operation.

Government’s Vision and unborn Plans

The launch of 500,000 digital holdalls

for women under the Ramadan package is part of a long- term vision to integrate further citizens, particularly women, into the digital frugality. The government aims to expand similar programs beyond Ramadan, gradationally furnishing access to millions more women across the country. also, authorities are exploring hookups with fintech companies, mobile banking providers, ande-commerce platforms to enhance the mileage of these holdalls. unborn plans include linking digital holdalls with savings accounts, microloans, and investment openings, empowering women to achieve long- term fiscal stability.

Witnesses and Early Feedback

Early heirs of the program have reported significant positive issues. Women in civic areas have expressed gratefulness for the convenience of digital deals, while pastoral actors appreciate the capability to admit finances directly without interposers. numerous women entrepreneurs have noted that digital holdalls

have helped them manage business deals efficiently, adding both income and profitable independence

unborn Prospects

The government’s action is anticipated to serve as a model for unborn programs aimed at promoting fiscal addition. By successfully integrating 500,000 women into the digital frugality under the Ramadan package, authorities hope to encourage farther relinquishment of fintech results across all demographics.

also, monitoring and evaluation mechanisms are being put in place to insure that digital holdalls

continue to meet the requirements of women druggies, address gaps, and acclimatize to evolving technological trends.

Explanation

The government’s decision to open 500,000 digital holdalls

for women under the Ramadan In a corner action aimed at promoting fiscal addition and empowering women across the country, the government has blazoned the opening of 500,000 digital holdalls

for women under the Ramadan package. This action forms part of a broader strategy to integrate women into the digital frugality and give them with accessible fiscal tools that can help them share in profitable conditioning with ease and security.

The move to give digital holdalls

to women under the Ramadan package reflects the government’s commitment to inclusive growth. Digital holdalls

are a accessible, secure, and ultramodern fiscal result that allows druggies to conduct deals, pay bills, admit finances, and indeed make online purchases without the need for physical bank accounts. For numerous women in pastoral and civic areas, this step represents a significant stride towards fiscal independence and commission.

Purpose of Opening 500,000 Digital holdalls for Women

The primary ideal behind opening 500,000 digital holdalls

for women under the Ramadan package is to enhance fiscal availability for women. Historically, women in numerous regions have faced hurdles in opening bank accounts or sharing completely in the fiscal sector due to social, artistic, and logistical walls. By launching this program under the Ramadan package, the government ensures that women can profit from a cashless, digital-friendly frugality.

The action also aims to support women entrepreneurs, small business possessors, and housekeepers who are decreasingly engaging in online and offline commerce. By furnishing them with digital holdalls these women can safely admit payments, manage their finances, and contribute economically without demanding expansive fiscal knowledge or access to traditional banking structure.

also, authorities are exploring hookups with fintech companies, mobile banking providers, ande-commerce platforms to enhance the mileage of these holdalls

. unborn plans include linking digital holdalls

with savings accounts, microloans, and investment openings, empowering women to achieve long- term fiscal stability.

Conclusion

The government’s decision to open 500,000 digital walletsfor women under the is a significant step towards fiscal addition, profitable commission, and gender equivalency. By furnishing women with secure, accessible, and ultramodern fiscal tools, the action enables them to share completely in profitable conditioning, enhance their livelihoods, and contribute to public development.

As further women embrace digital holdalls

, the country moves near to a cashless, inclusive, and technologically empowered frugality where women play a central part in shaping profitable growth. The Ramadan package not only provides immediate fiscal benefits but also sets the stage for a long- term metamorphosis in the way women interact with finance, business, and technology.

package is a significant step towards fiscal addition, profitable commission, and gender equivalency. By furnishing women with secure, accessible, and ultramodern fiscal tools, the action enables them to share completely in profitable conditioning, enhance their livelihoods, and contribute to public development. As further women embrace digital holdalls

, the country moves near to a cashless, inclusive, and technologically empowered frugality where women play a central part in shaping profitable growth. The Ramadan package not only provides immediate fiscal benefits but also sets the stage for a long- term metamorphosis in the way women interact with finance, business, and technology.

FAQs

1. Who is eligible to receive the digital wallets under the Ramadan package?

All women across the country, including homemakers and entrepreneurs, are eligible with minimal documentation.

2. Can these digital wallets be used for online transactions?

Yes, the wallets are fully equipped to facilitate online payments, bill settlements, and e-commerce purchases.

3. Is there a cost associated with opening the digital wallet?

No, the government provides the wallets free of charge under the Ramadan package.

4. Are these digital wallets secure?

Yes, the wallets are secured with advanced encryption and monitoring systems to protect user transactions.

5. Will there be training to help women use digital wallets?

Yes, the program includes guidance, tutorials, and support to ensure effective use of digital wallets.